South Asia will likely experience the fastest growth in the world for the next two consecutive years. However, this does not seem a moment of cherish for all regional economies. This boost is illusive, given that many economies are not self-reliant and growing far below the average due to many structural issues. Moreover, they are facing challenges in policy choices amid the series of post-COVID negative shocks such as the Ukraine war, climate catastrophes, and sluggish global economic activity. These economies are unable to avoid the mounting pressure of inflation, unemployment, and balance of payments problems. This grim outlook calls for a thoughtful prioritization of policy actions leading South Asia to the path of resilience.

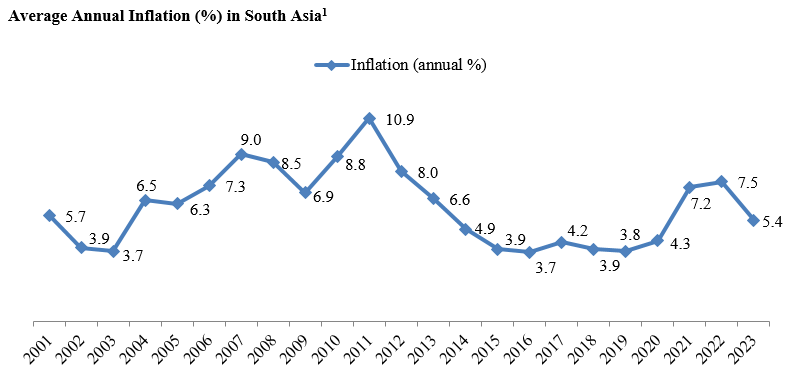

With global hikes in food and energy prices and capital outflows following the tight monetary policies in many advanced countries, inflation persistently is at the top of the nerves of South Asia. These challenges imply a less optimistic potential for long-term growth and economic welfare of the region. Literature sufficiently establishes that monetary policy is so called ultimate tool among others to manage inflation and output gaps to maximize societal welfare. The prime goal of monetary planning by central banks is to maintain a stable price level in respective economies. However, it is challenging in the face of policy trilemma comprising conduct of independent monetary policy, financial openness and keeping exchange rate stable. Authorities have to keep the exchange rate stable by effective management of reserves to avoid fiscal distractions.

To pacify the inflation beast, we need a good understanding of the monetary outlook of this region. Here is a brief overview of the monetary frameworks, challenges, and prospects for South Asia.

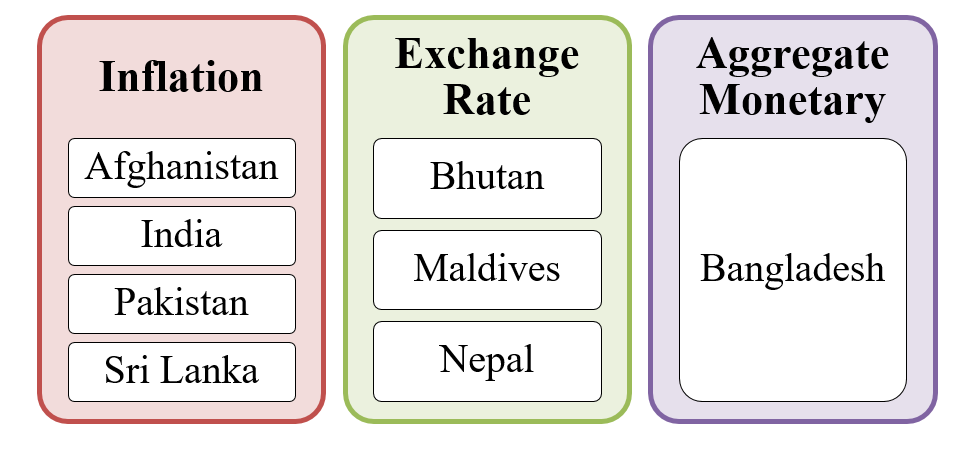

South Asian economies have diverse monetary frameworks in practice that include inflation, exchange rate, and aggregate monetary targets. In South Asia inflation targeting is the most commonly adopted framework. The monetary target for four out of eight South Asian economies is price stability and for three it is exchange rate while Bangladesh is the only economy to opt for a broad monetary targets [2].

1. Monetary Policy Target in South Asian Economies

Inflation targeting has flexibility, independence, accountability, and other key attributes that enhance the credibility of policy development and implementation. However, inflation targeting is not always desirable, especially for emerging and developing economies. These economies have to overlook inflation to achieve high growth and employment goals.

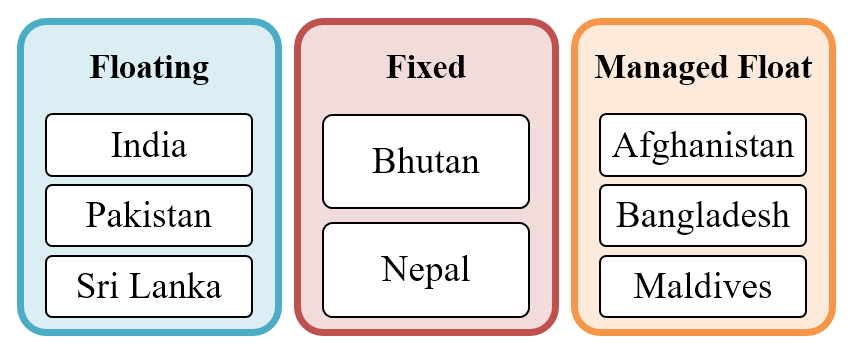

2. Exchange Rate Regimes in South Asian Economies

The conduct of monetary policy in any framework is constrained with existing exchange rate regime in the country. Like most other economies in the world, South Asian countries have followed a fixed exchange rate regime before embracing the financial sector reforms in the 1990s. After adopting reforms, domestic central banks became more dependent on leading central banks of the world due to imported inflation and volatility in capital flows. Therefore, keeping exchange rate flexible for inflation targeting is crucially important for emerging and developing economies like those in South Asia. India, Pakistan, and Sri Lanka follow a floating exchange rate regime while Bhutan and Nepal have fixed exchange rates anchored to the Indian rupee. Afghanistan, Bangladesh, and Maldives have managed float policy.

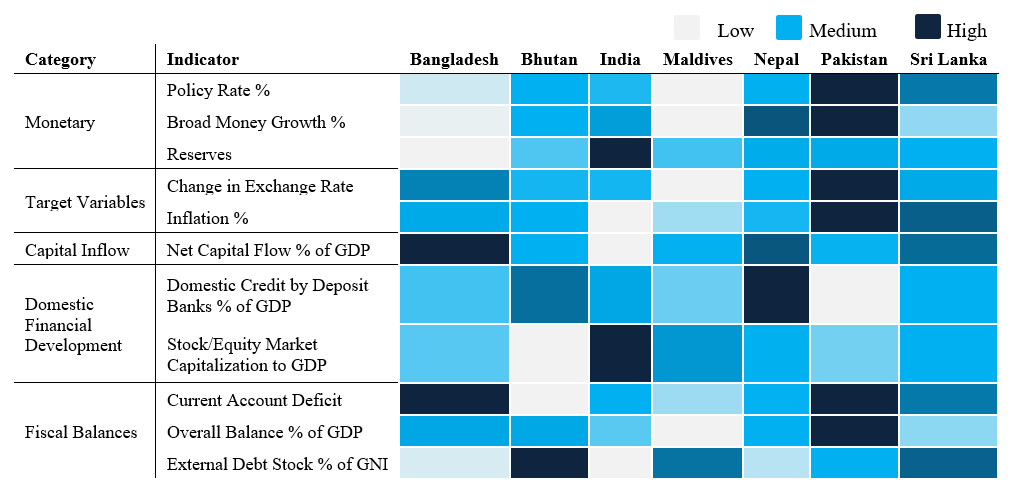

3. Monetary and Financial Outlook of South Asian Economies (2024)[3]

The regional overview presents that economies targeting price stability are keeping their policy rates medium to very high. Bangladesh follows a mix of monetary targets and has the lowest money growth in the region. India owns the highest reserves position while the rest of the economies own medium to low reserves. Pakistan is experiencing high volatility in its currency value and is declared as an emerging economy at high risk of currency crises. It also has the lowest financial position in terms of domestic credit by deposit banks. It refers to the fact that the private sector of the economy has a dearth of financial resources despite having the highest interest rate in history. Monetary policy effectiveness is subject to financial and fiscal structure yet Pakistan’s economy has the poorest state in both sectors. India has successfully achieved its price stability through a flexible monetary policy that is anchored with inflationary expectations. Currently, India has the lowest inflation rate in South Asia with a sound financial and fiscal position.

Overall monetary policy in the region except India is not working well in terms of keeping a stable price with a high growth rate and stable currency value. In this situation, South Asian economies may opt for the interior solution practiced by emerging Asia. It requires independent conduct of monetary policy with partial openness of the financial sector and partial management of the exchange rate. In addition, Indian monetary policy can be directive to other economies in the region. Given this, it is suggested that monetary authorities must maintain a rule-based broad monetary policy flexibly to reduce time inconsistency and improve credibility. A flexible target of price stability is an unconventional framework that requires medium-term nominal anchoring of the policy. Therefore, the quality of data and timely information is a big challenge that must be addressed for effective implementation.

Lastly, it is evident from the situation of South Asian economies that central banks cannot address inflation and other inefficiencies in isolation. Better institutional arrangements, financial stability, and strong coordination with fiscal policy are inevitable for stability goals. It requires all policymakers to internalize the consequences of their independent decisions and avoid a lack of coordination among monetary, fiscal, and financial policies of an economy.

Footnotes

[1] Compiled using data of WDI from https://databank.worldbank.org/

[2] Ghate, C., & Ahmed, F. (2023). On Modernizing Monetary Policy Frameworks in South Asia. South Asia’s Path to Resilient Growth, 283.

[3] Compiled using data from WDI (https://databank.worldbank.org/) and IMF (https://data.imf.org/)

Table of Contents

Toggle

1 thought on “Monetary Overview of South Asia”

insightful analysis of monetry policy. can u plz explain broad montery targets a lil bit more?